nj bait tax explained

New Jerseys PTE workaround has received a lot of attention as it is one of the highest-taxed states in the nation. The New Jersey BAIT was designed as a work-around to the 10000 federal limit on the deduction of state and local taxes enacted in the Tax Cuts and Jobs Act of 2017.

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

At BSM weve been helping our clients take advantage of the new tax law.

. Signed into law in January the BAIT is a new elective. Pass-Through Business Alternative Income Tax Act. What It Actually Is.

Despite the confusion caused by calling it an exit tax the law simply requires the seller to pay state tax in advance calculated as follows. Pass-Through Business Alternative Income Tax Act. The BAIT is an elective entity-level tax which.

New Jersey Governor Phil Murphy recently signed legislation modifying the states Business Alternative Income Tax BAIT regime. Phil Murphy D signed S 4068 which revises the Business Alternative Income Tax BAIT by amending the calculation of the tax. New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT.

In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT. NJ BAIT Apportionment Factor For tax year 2021 S Corporations will have the option of using the single sales factor or the three-factor formula Sales Payroll Property to. Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M.

New Jersey withholds either 897. On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law. On January 18 New Jersey Gov.

Until 2022 there is a middle bracket of 912 for. Enticing Businesses with New Jersey BAIT The pass. This change does not affect TY 2020.

As the New Jersey Division of Taxation rolled out its interpretation and guidance of the Business Alternative Income Tax BAIT serious concerns surfaced. This is an entity-level tax to work. The tax is calculated on every members share of distributive proceeds including tax exempt.

Give us a call at 973-478-4846 or book a call at your own convenience with one of our. A tax-saving technique for New Jersey pass-through businesses has been improved under a new state law enacted this week that will help small business. PL2019 c320 enacted the Pass-Through.

First if you have a primary home in New Jersey for which you paid 200000 and are selling for 275000 you need to look at Form GITREP3 - Sellers Residency. And we can help you too. The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income.

Dodge Road Trip Exploring New Jersey S Other Shore The Bayshore Geraldine R Dodge Foundation

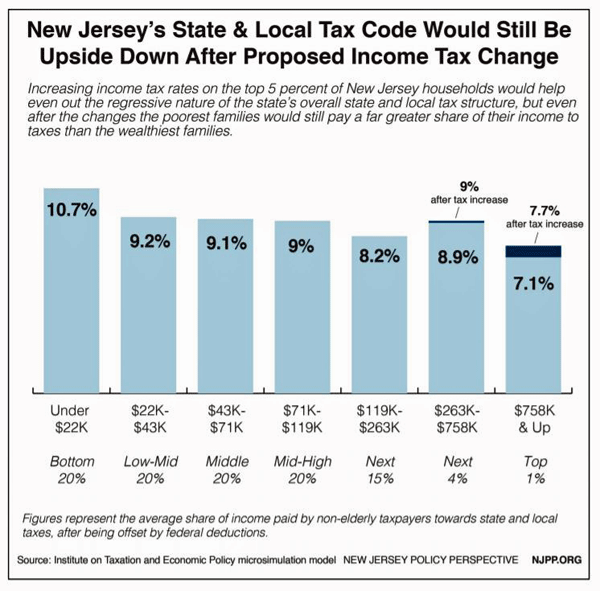

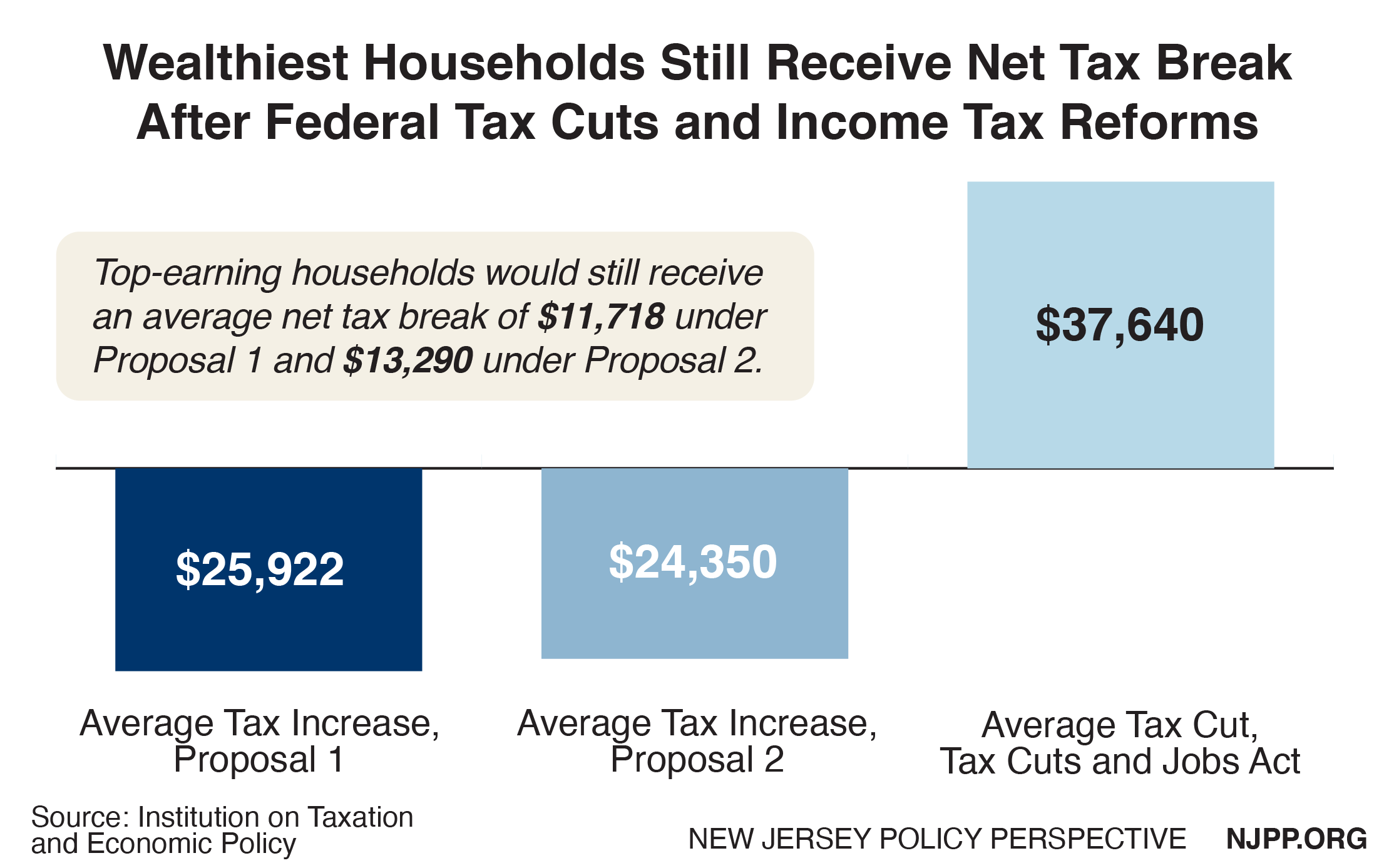

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

House Just Voted To Restore Your Property Tax Break As Part Of 1 75t Spending Plan Nj Com

New Jersey Cpa January February 2021 By New Jersey Society Of Cpas Issuu

New Jersey Homeowners Guide To Property Taxes Toolkit

Nj Bait And New Salt Guidance What You Need To Know Smolin

New Jersey Businesses Should Consider Salt Deduction Limitation Withum

Nj Pass Through Business Alternative Income Tax Professional Services

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

New Jersey Establishes Elective Entity Tax For Pass Through Entities Deloitte Us

What Is New Jersey Business Alternative Income Tax Nj Bait Tax Tax Tips With Ajay Kumar Cpa Youtube

This Is What Happens When You Add Ira Tax Benefits To Retirement Plans

.png?Status=Master&sfvrsn=88ed713a_0)

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

These States Offer A Workaround For The Salt Deduction Limit

Number 13 Pages 1635 1832 Law Library The New Jersey State

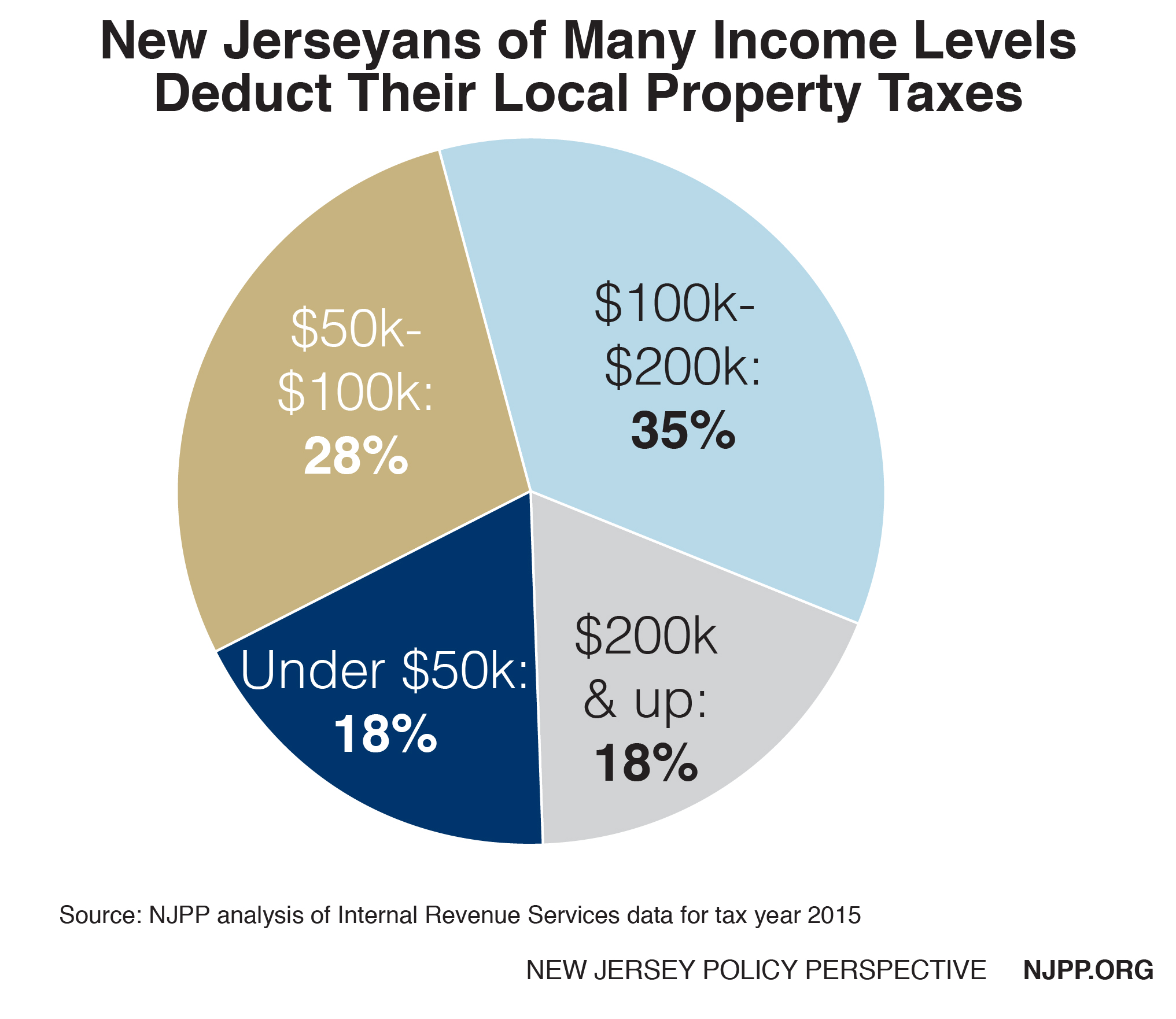

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each Year New Jersey Policy Perspective